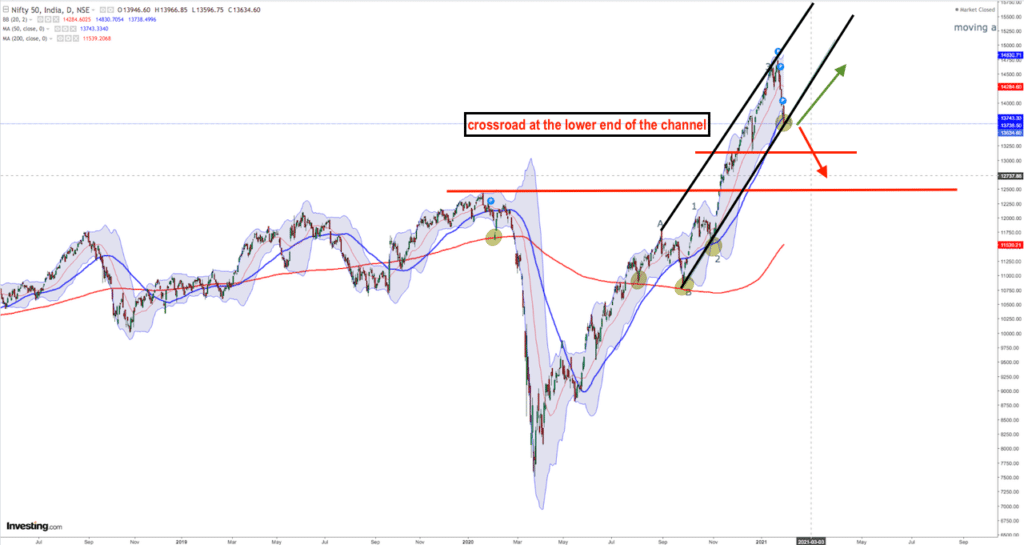

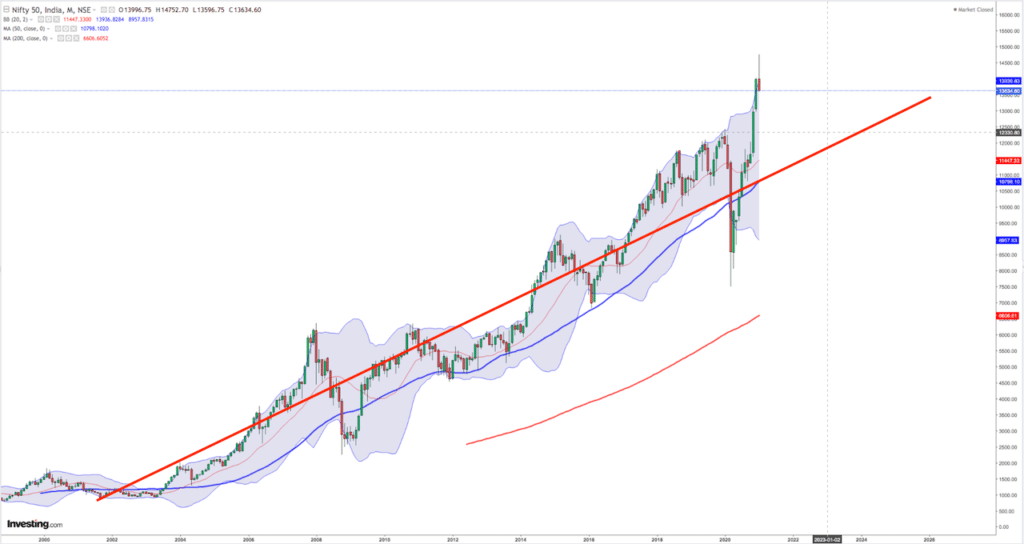

The markets have come to rest exactly on the lower end of the up channel since the big fall in the early part of 2020.

Previously the markets revived from the lower end to move higher. This time will same upward move will happen or a collapse downwards will take place is something we have to watch carefully.

In our last post , had similarly pointed out why we should be cautious and NOT carry any positions overnight.

This stated cautionary approach still holds valid and the direction the markets will take will take will depend on the price action in the next one or two days. The markets MAY move sideways sloping upwards or may just tank right away are the two possibilities.

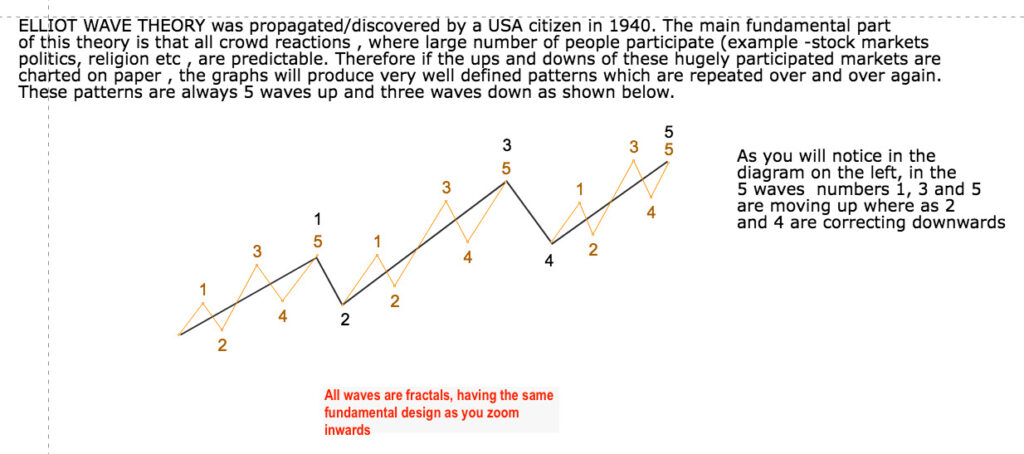

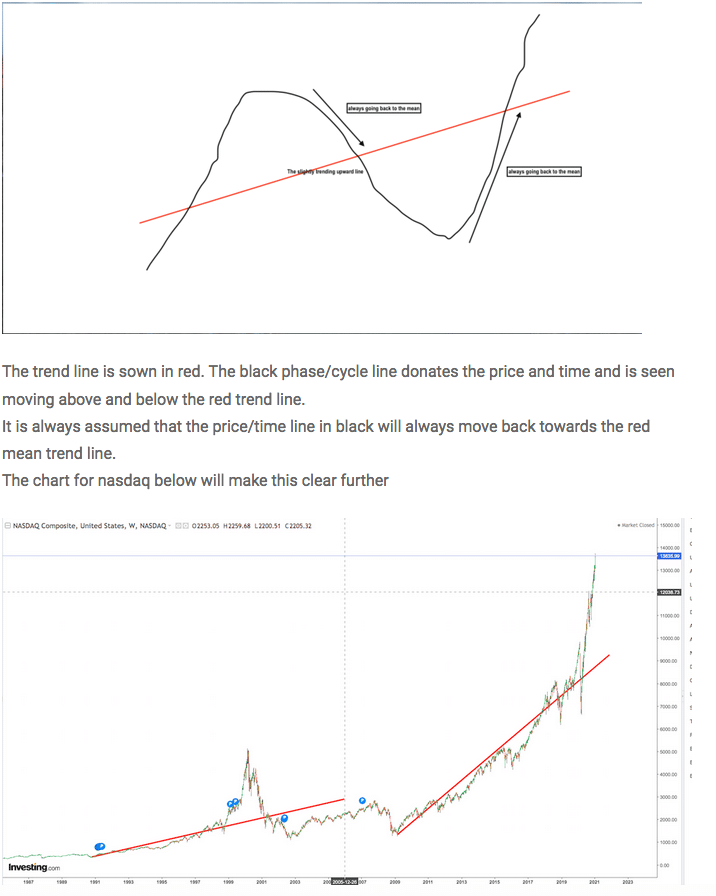

Please consider following theory put forward by many pandits before(Howard Marks) . The markets move around a central slightly sloping upward bullish mean line. The price action takes place around this line as phases.

The markets always tend to come back to the mean levels , specially when they have a swift climb upwards. In the move to come to the center line they mostly move to the other side and the momentum can carry it to the extremes..

This have tried to shown in a basic diagram below

Further the chart of nifty too shows the same inclination

As the markets are at a cross road(can move few hundred points up from here OR can collapse) one should be extremely cautious.

Have done a quick analysis of the major heavyweights in the NIFTY and the bearishness among frontline stocks seen, can only bolster the extreme cautionary approach. For Nasdaq have not done the stock analysis of the major constituents as yet but will revert on same .