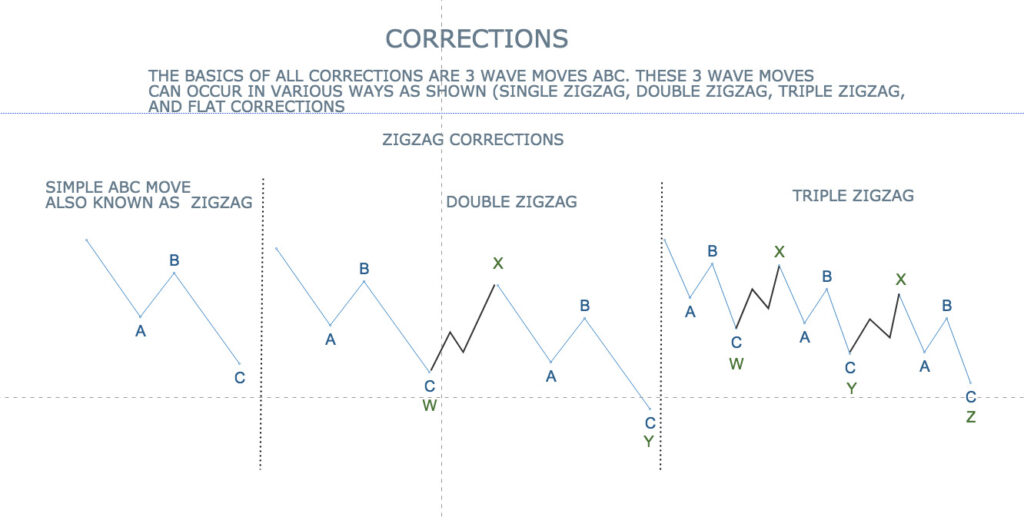

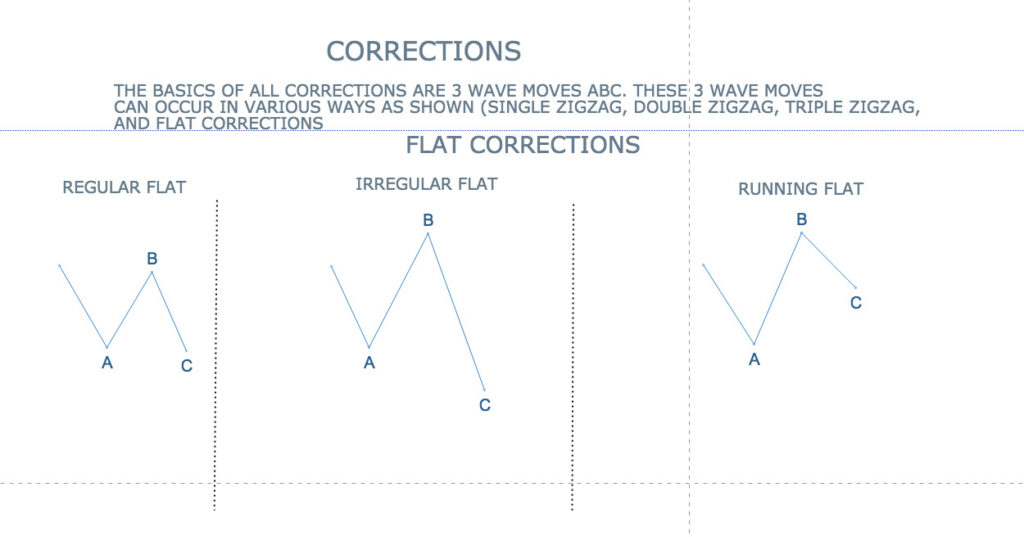

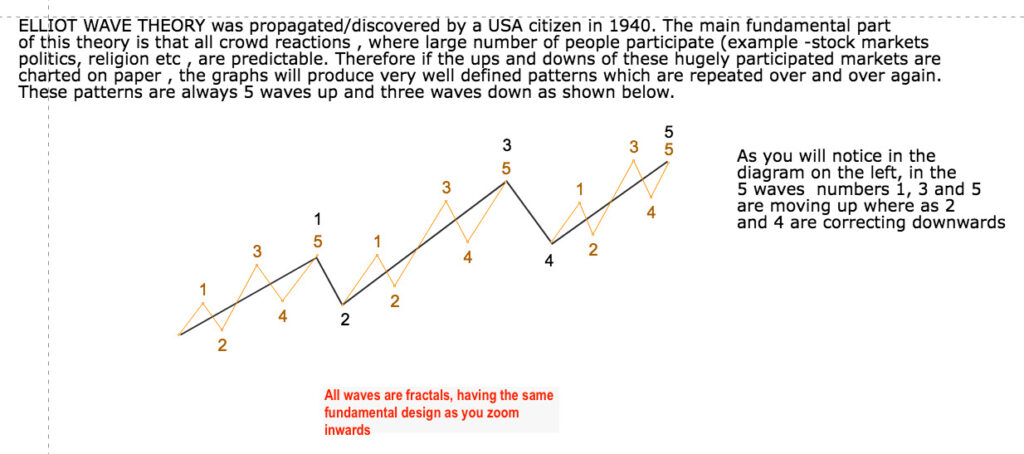

The Nifty appears to be in a corrective wave B following the completion of primary wave 3 in September and wave A in November. As wave B progresses upward, it may test key Fibonacci retracement levels, potentially retracing up to 50-61.8% of wave A. However, this movement is likely to be capped by reduced momentum, suggesting wave B is part of a broader corrective structure.

The expected subsequent triple zigzag in wave C could bring significant downside risk once wave B concludes. Wave C may align with deeper retracement levels of primary wave 3.

Fundamentally, concerns persist. Rising inflation, sticky interest rates, and global liquidity tightening weigh on equities. Geopolitical overtones—particularly the intensifying Russia-Ukraine conflict—may exacerbate risk aversion, disrupt energy markets, and weaken sentiment in emerging markets like India.

NIFTY

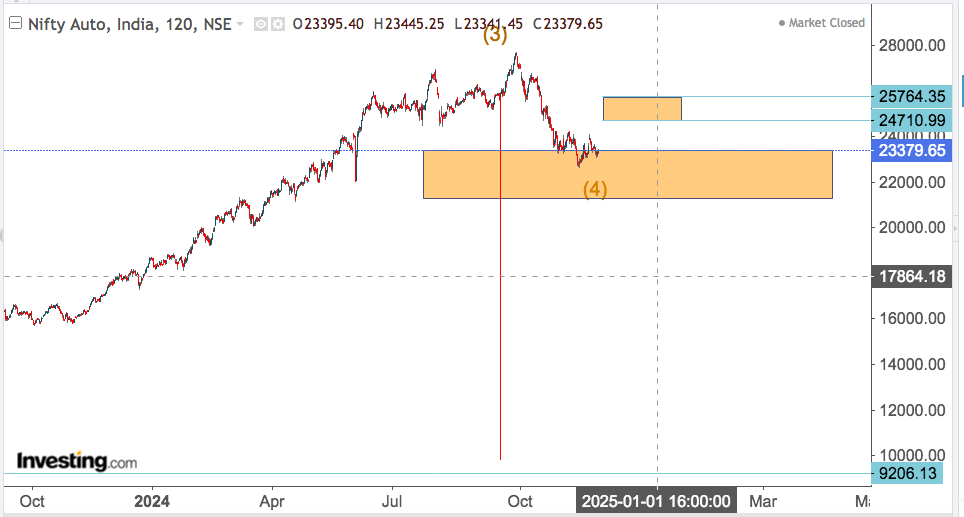

NIFTY AUTO

HERO MOTOCORP

TATA MOTORS

NIFTY BANK

INDUSIND BANK

SBI

NIFTY FMCG

ITC

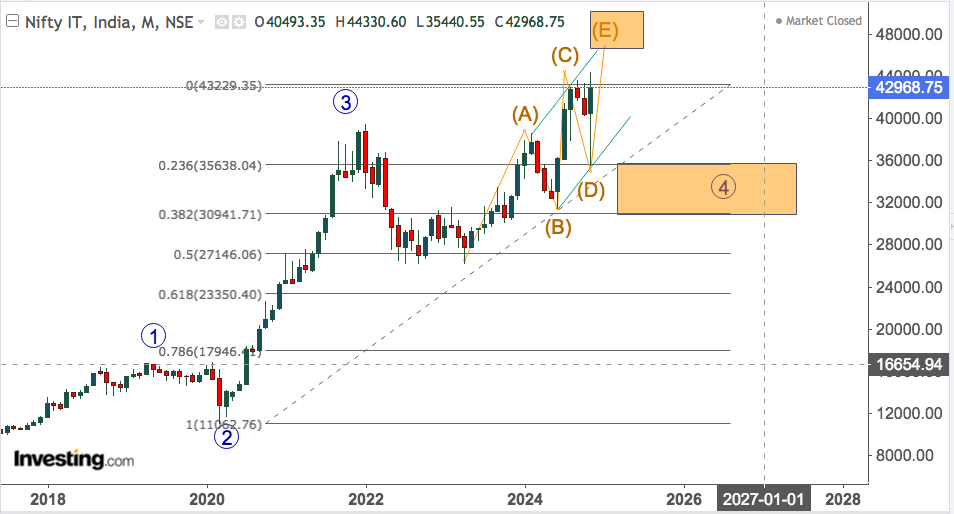

NIFTY IT

HCL TEC

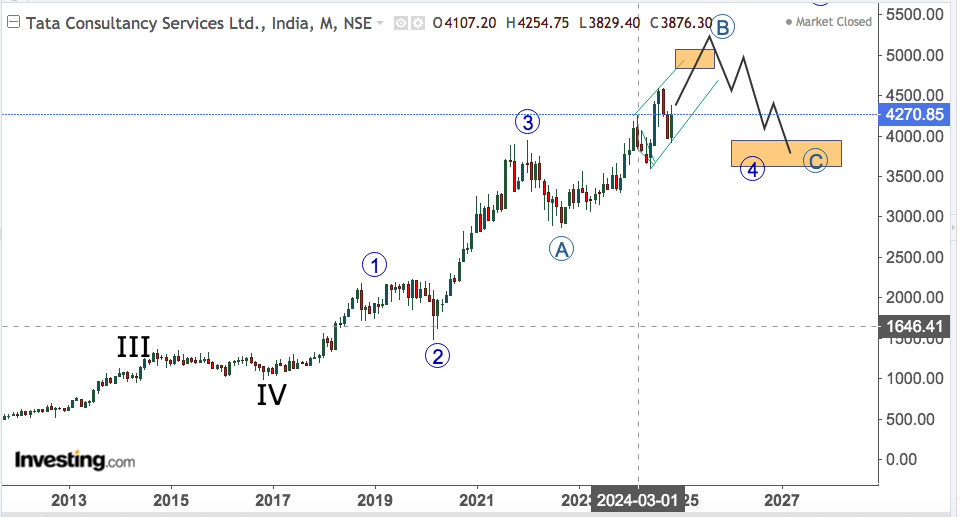

TCS

NIFTY OIL AND GAS

ONGC

BPCL

NIFTY PHARMA

CIPLA

DR REDDY

GOLD

Gold appears to be in a flat corrective structure following the completion of minor wave 3 at 2791 in October 2024. The current upward movement within this correction is likely a counter-trend rally, possibly testing or slightly breaching the October highs before another correction drags prices down to the 2540 level, which aligns with the support zone and potential wave C target.

Fundamentally, gold’s cost of carry remains favorable amidst geopolitical risks and central bank demand. The intensifying Russia-Ukraine conflict and broader geopolitical instability are boosting safe-haven appeal. Additionally, persistent concerns over inflation and potential delays in global rate cuts add to gold’s long-term bullish case.

Once this flat correction concludes, gold is poised for a sharp rally in a new impulsive wave, targeting significantly higher levels. The next major upward move could be fueled by declining real yields, weakening USD prospects, and central banks’ continued diversification into gold. Traders should watch for consolidation near 2540 as a potential accumulation zone for the next major rally.

NASDAQ

APPLE

MICROSOFT

NVIDIA

SHOPIFY

DEFENCE STOCKS

BHARAT DYNAMICS

BHARAT ELECTRONICS

HAL