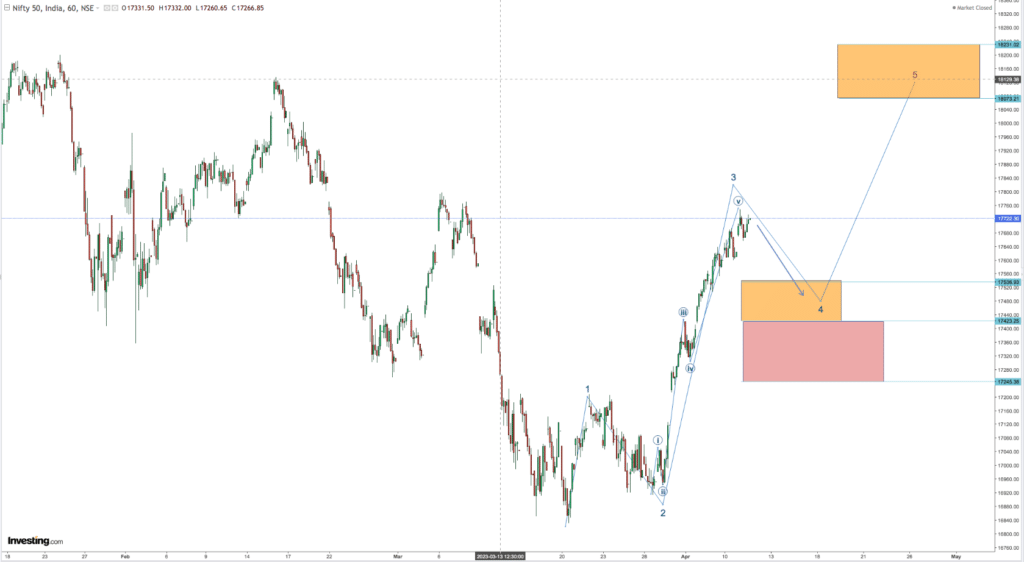

NIFTY Overbought both on an hourly and daily basis. Elliot wave count shows the completion of minor wave 3 and we should correct it from somewhere here.

The correction when it comes may not be very deep due to ongoing momentum.

WILL THE LAST BOTTOM HOLD

There is no indication as yet if the last bottom at around 16800 will break anytime soon. However, can expect the markets to form some sort of base between the present level and 16800. The strength and nature of the EXPECTED correction will tell us what to expect in the coming months.

EXPECTED PATTERN

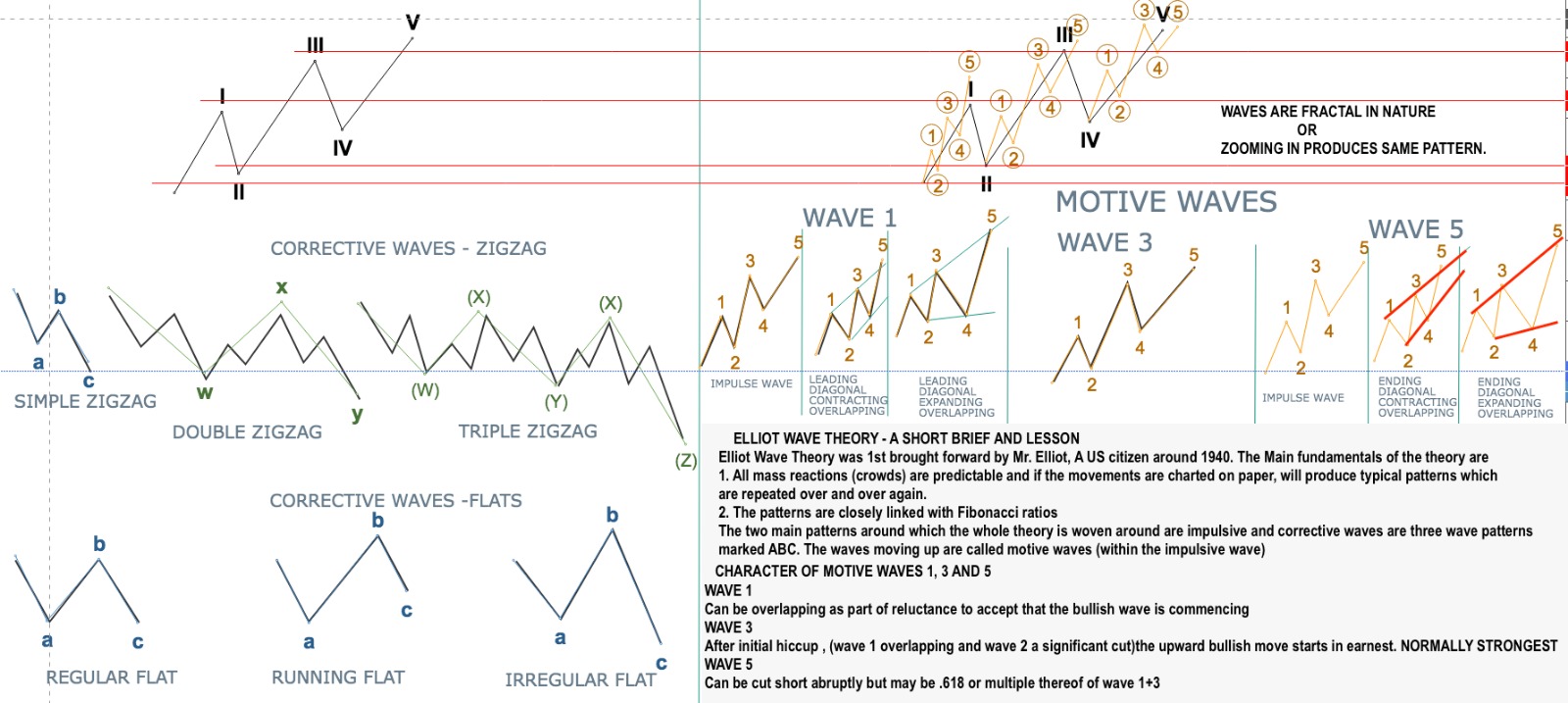

On the Elliot count, expect wave 4. Wave 4 is normally complex and long drawn out as described below

Wave 4 is a retracement: Wave 4 is a countertrend move that retraces a portion of the price movement of the preceding impulsive Wave 3. It usually retraces between 38.2% and 50% of the distance covered by Wave 3. This means that the price pulls back or corrects a significant portion of the gains made during Wave 3.

Wave 4 is complex: Wave 4 tends to be more complex and time-consuming compared to other Elliot Waves. It often unfolds as a sideways or overlapping pattern, rather than a clear and sharp price movement. It may take the form of a triangle, flat, or complex corrective pattern.

Wave 4 exhibits alternation: Elliot Wave Theory suggests that Wave 4 tends to exhibit alternation with Wave 2, which means that if Wave 2 was a simple correction, Wave 4 is likely to be more complex, and vice versa. This means that the structure and characteristics of Wave 4 may differ from that of Wave 2, providing traders with additional insights for their analysis.

Wave 4 does not violate the territory of Wave 1: In Elliot Wave Theory, Wave 4 typically does not retrace beyond the price territory of Wave 1. This means that Wave 4 should not exceed the starting point of Wave 1 in the direction of the trend. If the price goes beyond this level, it may indicate that the wave count is incorrect, and traders may need to re-evaluate their analysis.