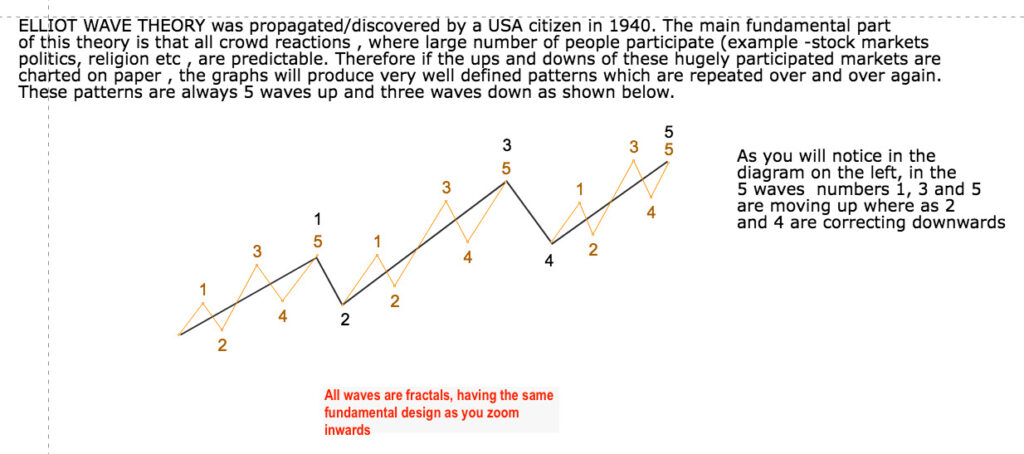

Elliot wave count needs to be understood to ensure that ones timing for trading is ALWAYS safe. One also needs to understand if the markets are overbought or oversold.

Before we move ahead with the discussion for correct timing, one needs to understand the basic difference between an investor and a trader. An investor holding on to his good quality stocks will not lose but come out a winner everytime.

A long term investor does not believe in taking out his investments come what may. IN THE LONG RUN he will win of course if his investments are made in good value stocks. (Markets are always upward graded in a slight slope in the long term. ). A long term investor does not have a stoploss. However if you are plus 60 , you may not like to see even medium term losses let alone in the short term.

Below discussion is about trading for those who LIKE to trade and of course for all ‘old men in hurry.’

For trading with elliot wave one must also utilize the option trading (Strictly with the TREND)

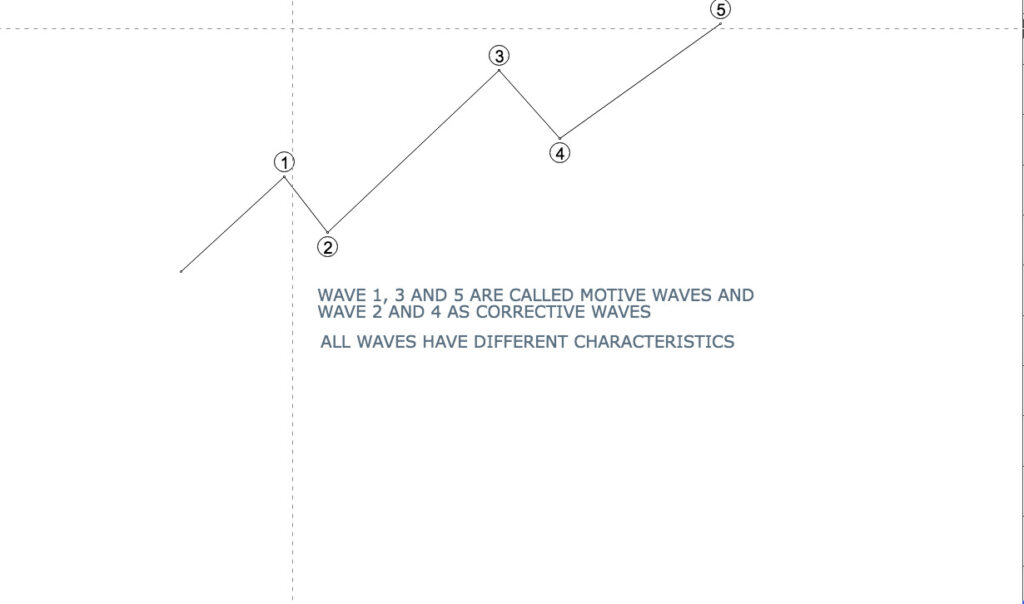

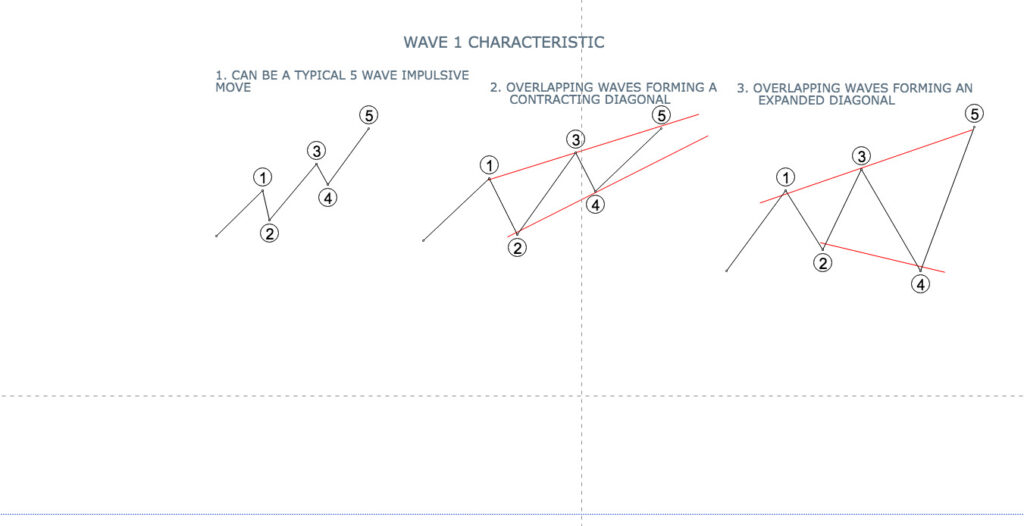

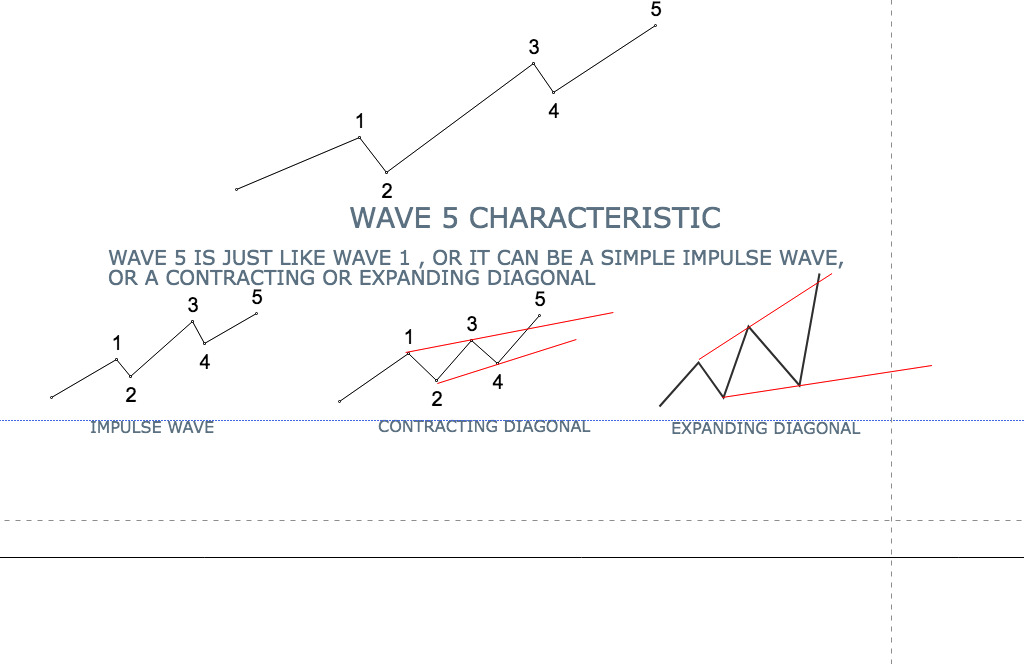

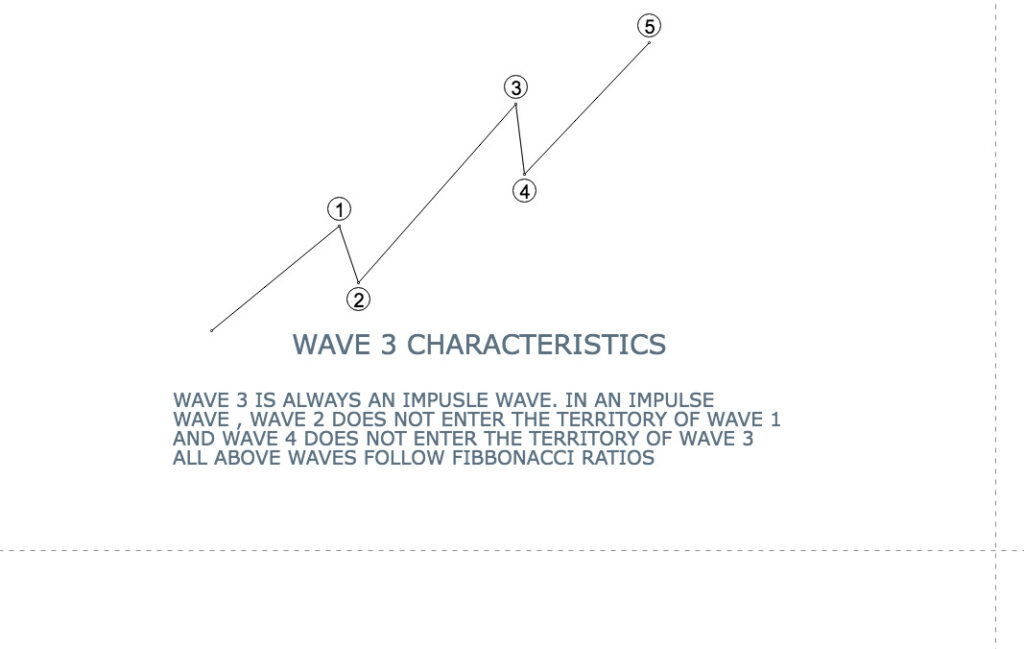

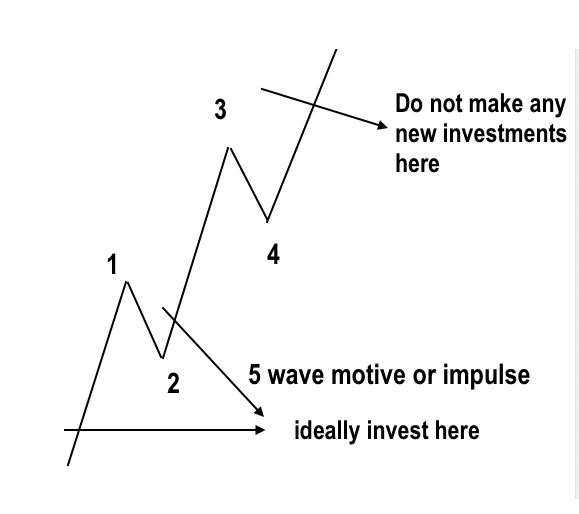

Consider the simple 5 wave move up for the elliot wave. We are of course considering a long term trend. If we missed the boat at the bottom of wave 1 , we still get a chance at the commencement of wave 3.

At the downturn (Which you can never be hundred percent sure at the EXACT timing) one must tread with caution. Selling call options at the first major downturn and THEN the Pullback give you atleast an eighty percent edge over the markets.

Presently the markets are not only overbaught but also as per the wave count nearing a major wave ending. Therefore it does no harm in booking part profits whenever one can , depending upon ones set horizons in the markets.