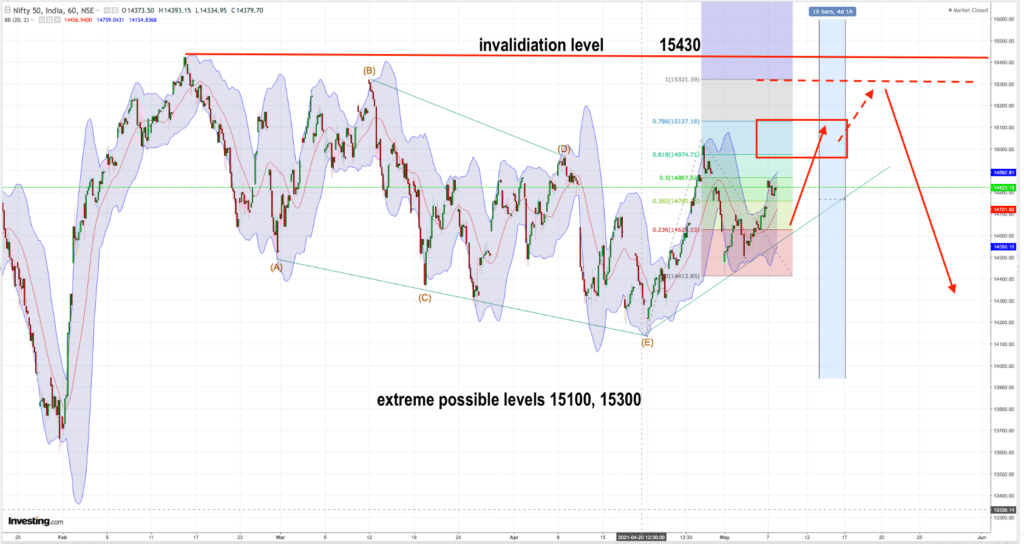

The markets have shown lot of volatility lately. Any extreme volatility is indicative of a major move upward or downward.

Presently the markets are slated to go upward within the bearish wave count.

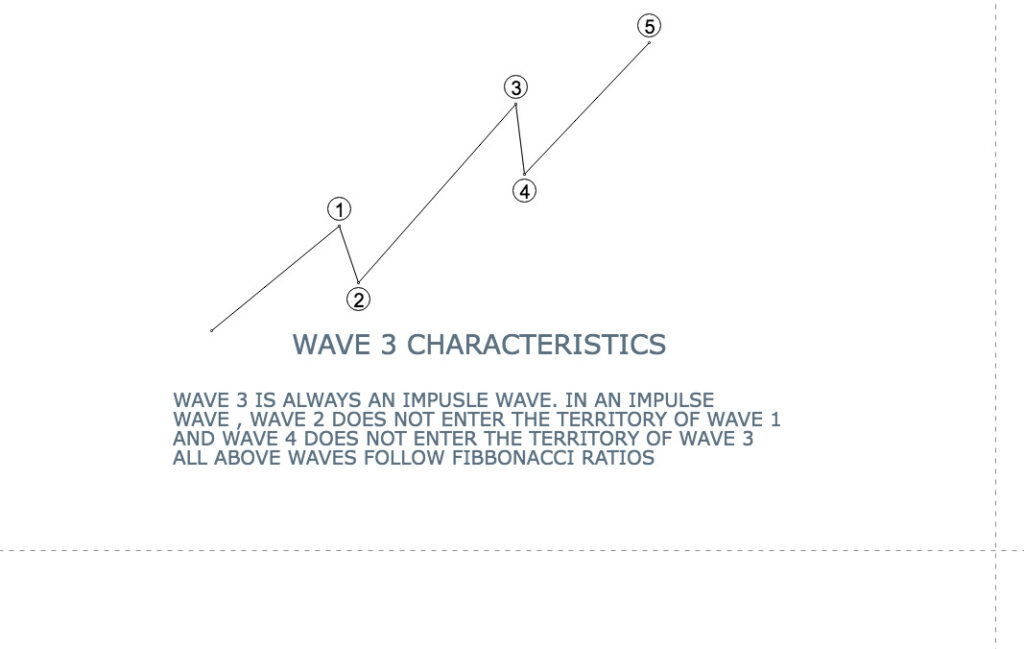

Markets made a top in mid feb 2021. From thereafter the markets have moved in a range with downward bias . As per the wave count the CORRECTIVE diagonal ended at 14175 in 3rd week of april. Now the markets are CORRECTING the above mentioned diagonal in an upward move.

The volatile move expected upward today is to be taken as a upward correction within an ongoing downward bearishness. The markets as per our wave count still need to finish the downward pattern and correct to sub 14000 levels.

The time frame for the downward correction to start as per fibonacci time grading comes to end of this week or early next week

However IN CASE the markets move beyond 15430 and consolidate there , the wave count will change in favour of bulls for a very long time. (Although this possibility is remote, mentioning this to have all possibilities in mind. This possibility will also bring in the biggest long duration bubble to date)

Standard Disclaimer

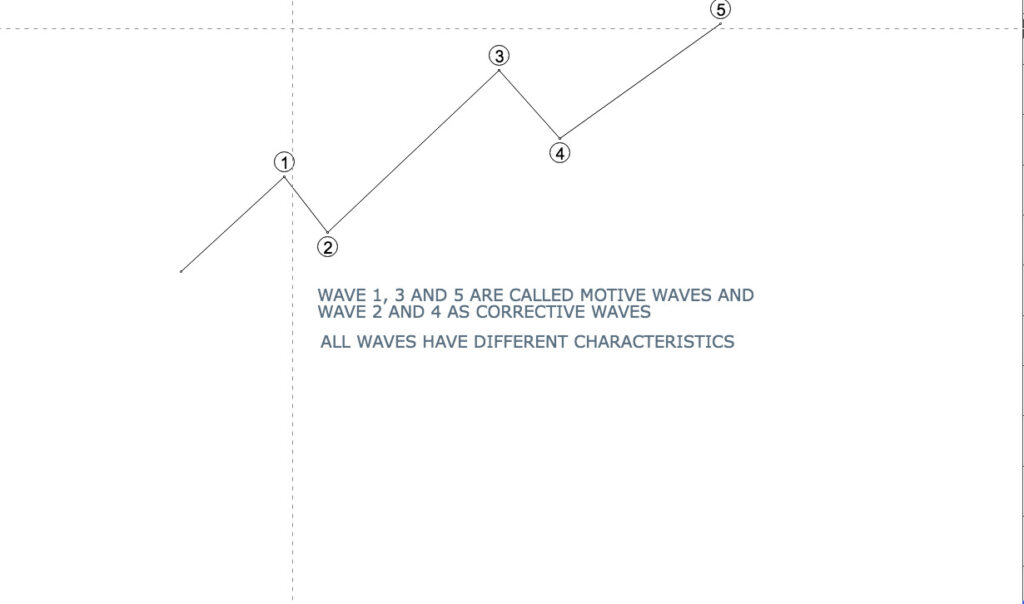

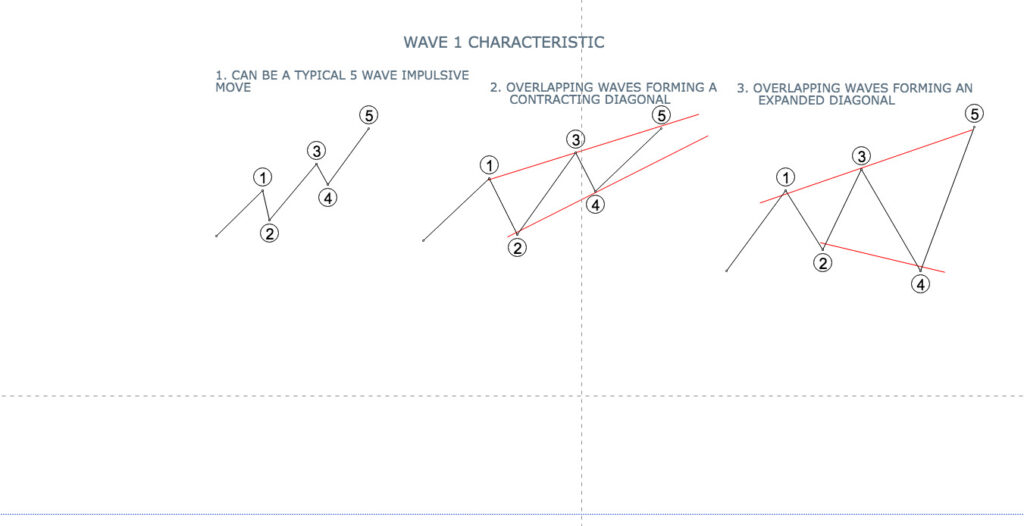

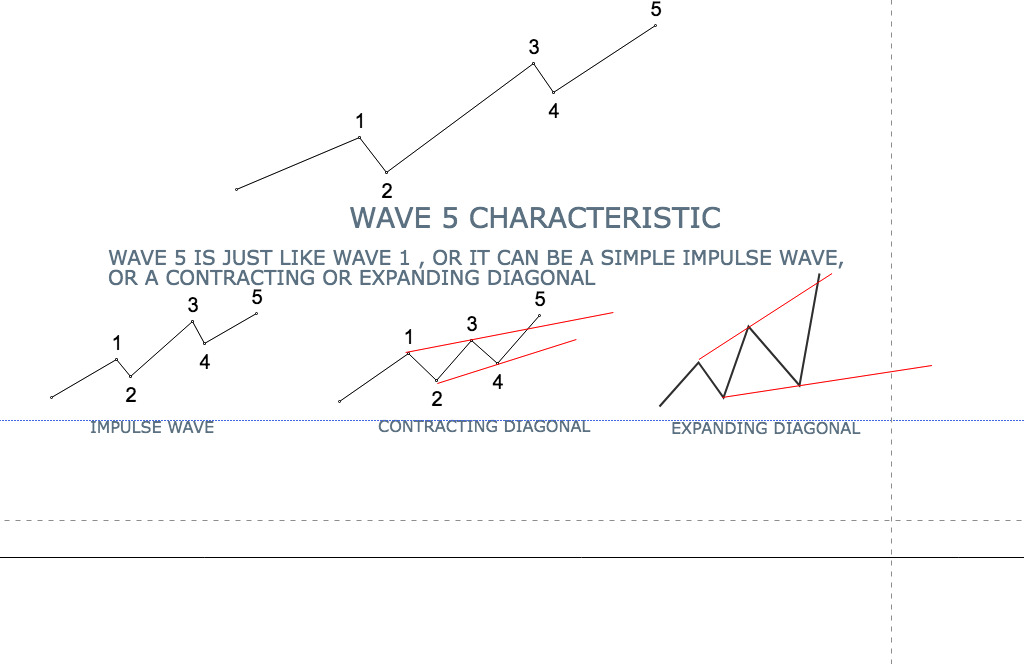

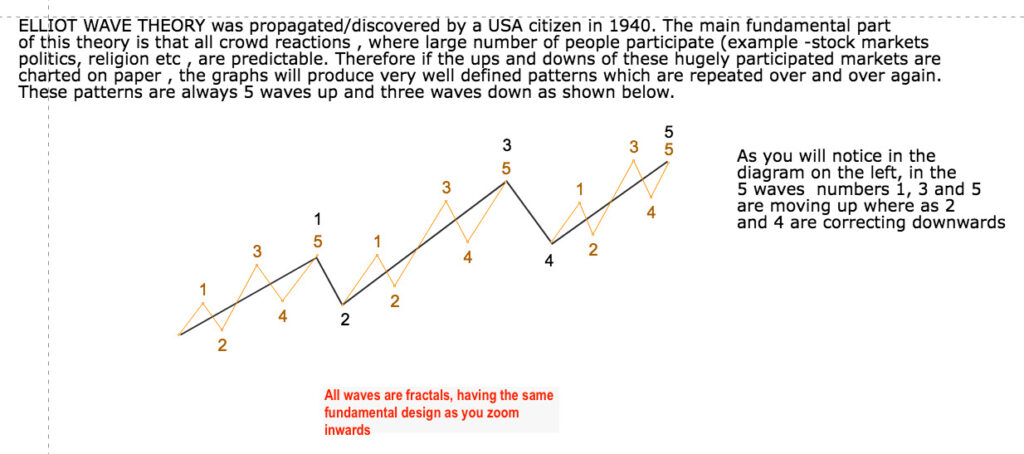

The above market analysis is based on elliot wave count. Elliot wave analysis is always based on considering a range of possibilities and choosing the most likely one. This analysis is never definitive and must be taken as just a possibility. For investing please consult a Certified Fundamental analyst on your own.