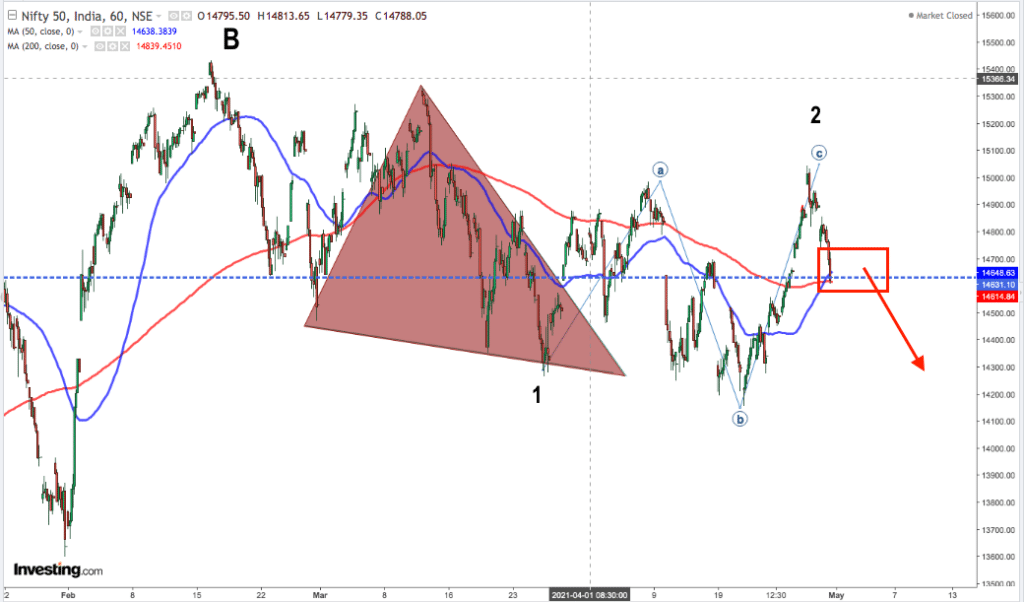

In our last post , we had mentioned Nifty being in the bear run and falling till 12000-13500 levels. We had also mentioned that this fall will not happen in one shot but will come around in a slow graded fashion and may take 4-6 months.

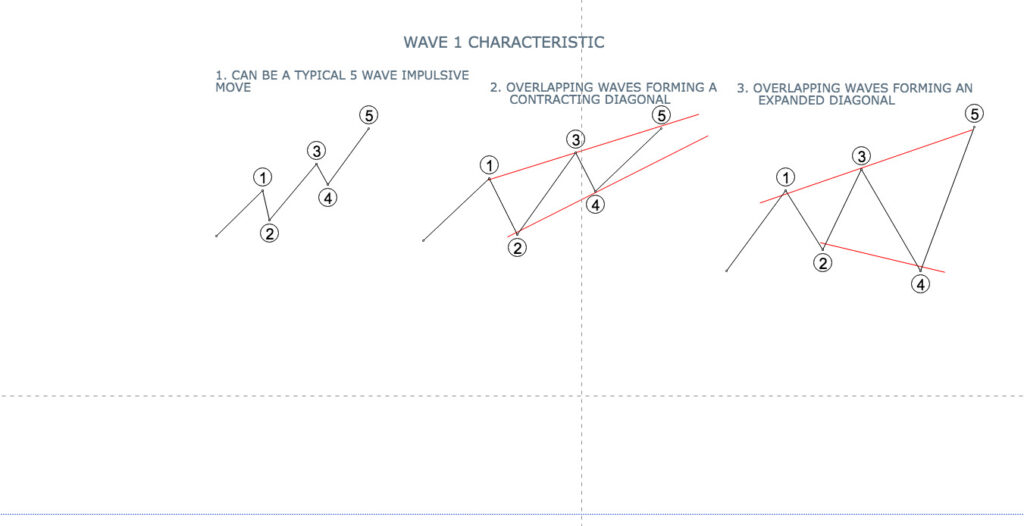

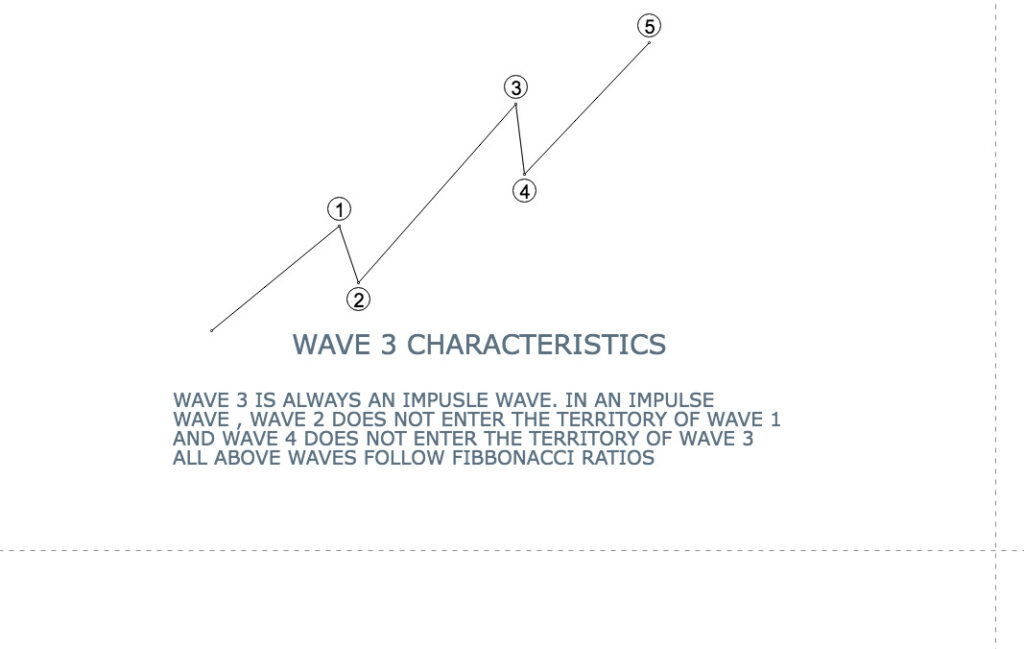

We re still maintaining our bearish wave count. The markets have completed a huge corrective wave ‘B’ from the covid lows one year back. Now we made a diagonal indicating a formation of wave ‘1’ Thereafter we made a wave 2 as a expanded flat.

If the above count is correct, on monday we may have an uptick and then falling to internal wave 5 of the larger wave 1 which can result in another bout of pullback .

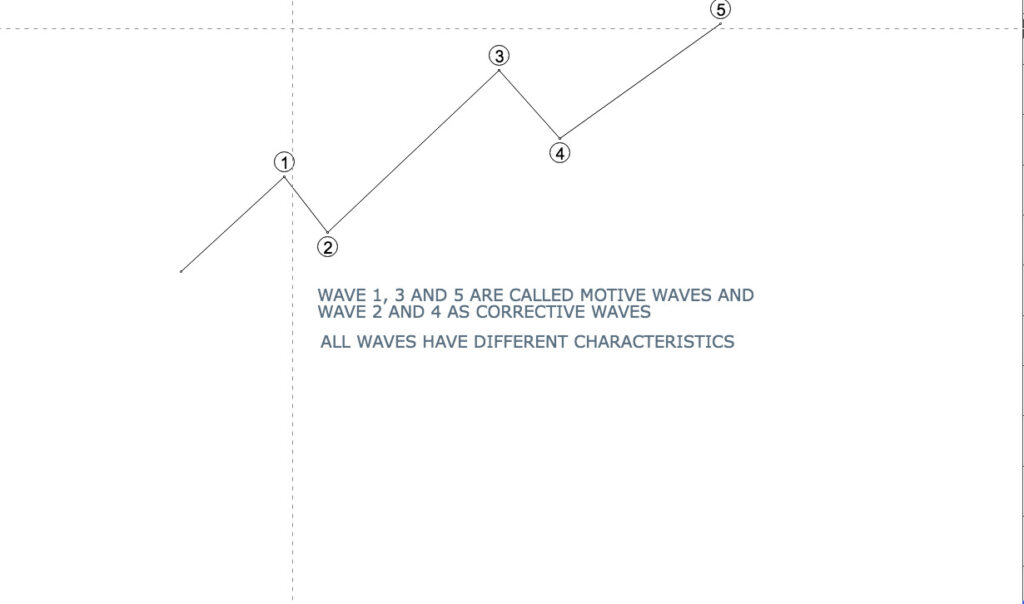

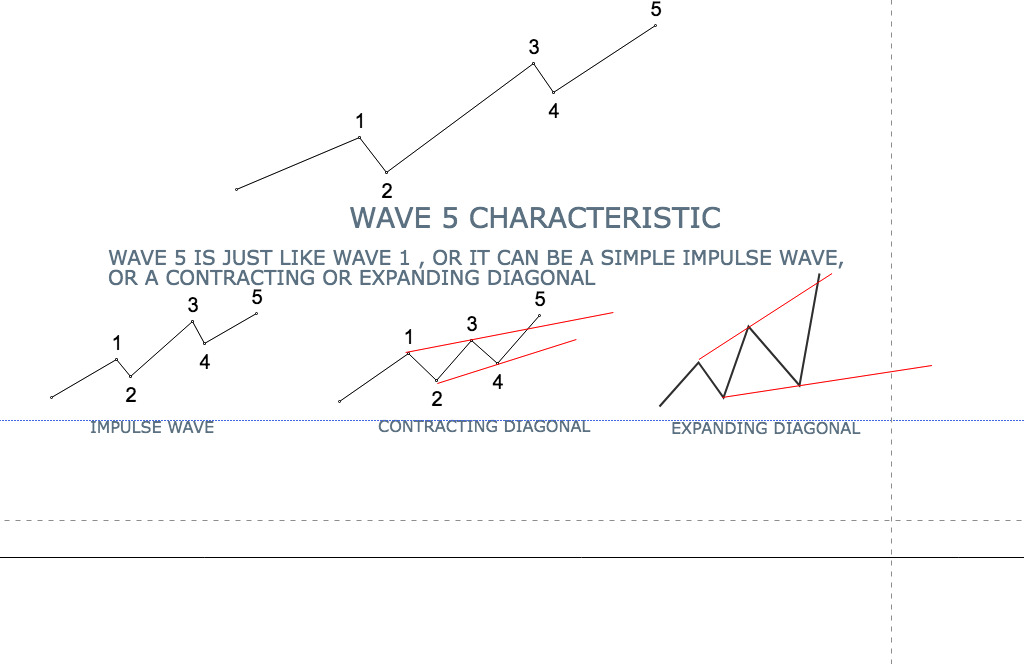

Charts below will make this more clear

Most likely the wave 2 is completed and wave 3 down is on . Within this wave 3 down , the 1st wave is about to complete and we may have an intraday move up.

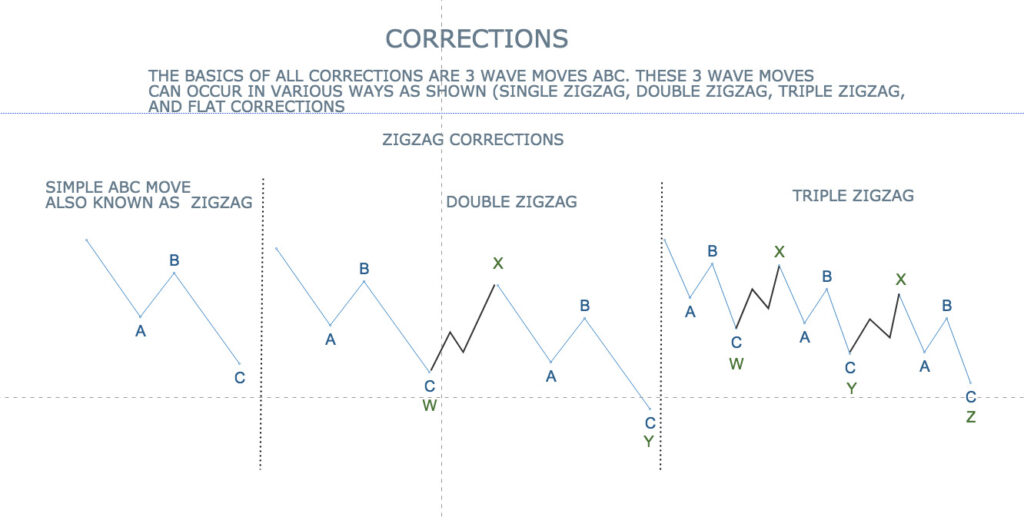

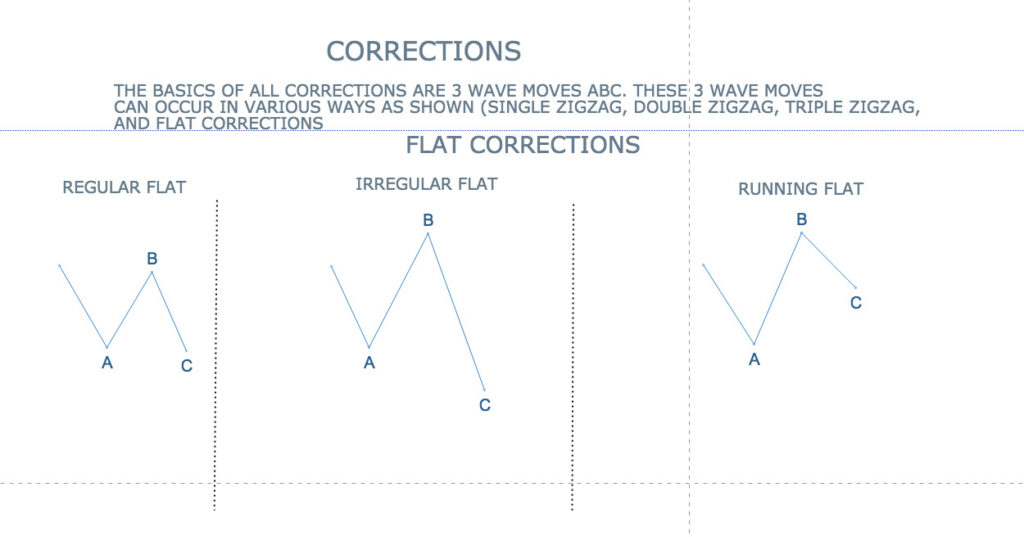

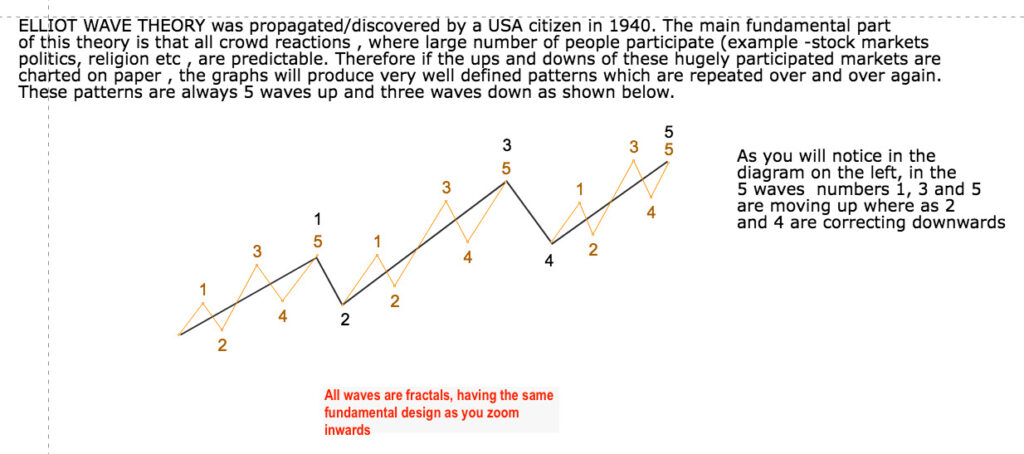

Disclaimer- Above analysis or any other analysis in this forum is based on elliot wave analysis. This theory is based on range of possibilities and is certainly subjective in nature(different analysts may pick out different possibility.

For any investment deployment , you are therefore advised to consult a certified fundamental analyst . Above analysis is to be taken only as one of the many possibilities.