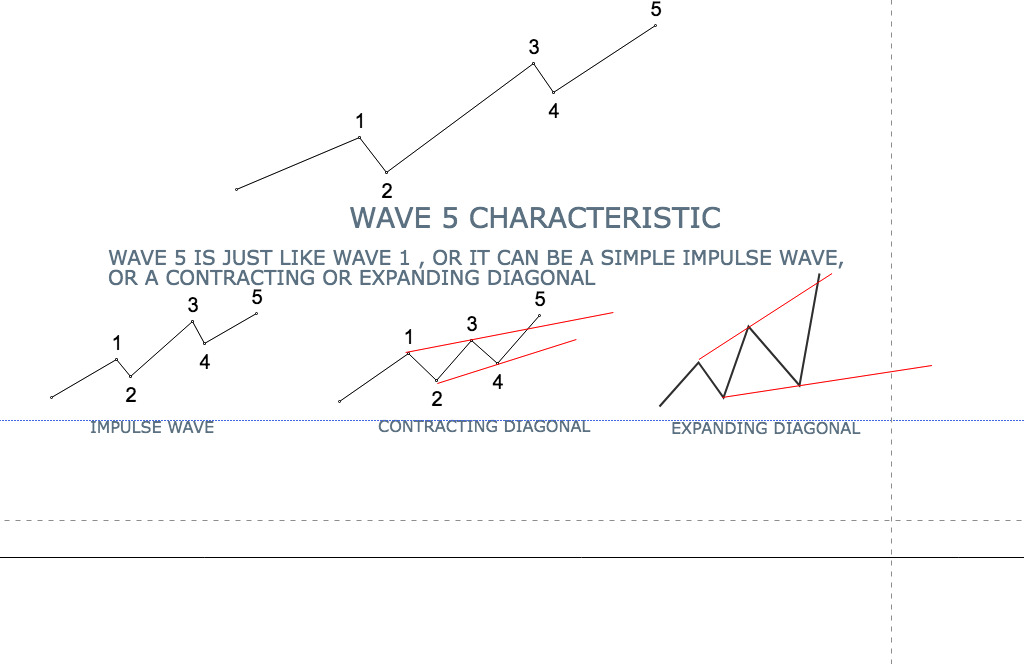

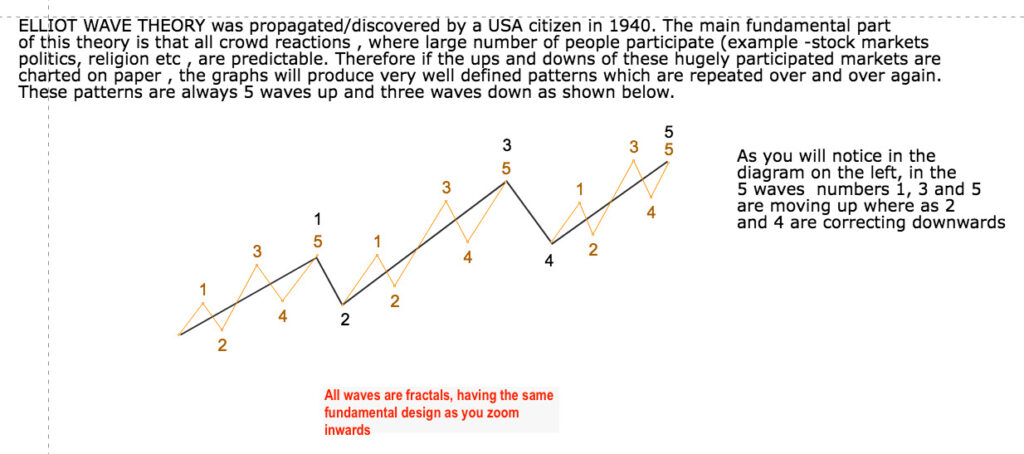

The 5th wave was further extended yesterday PROBABLY due to short covering. The market is definitely overbought both on an hourly and daily basis.

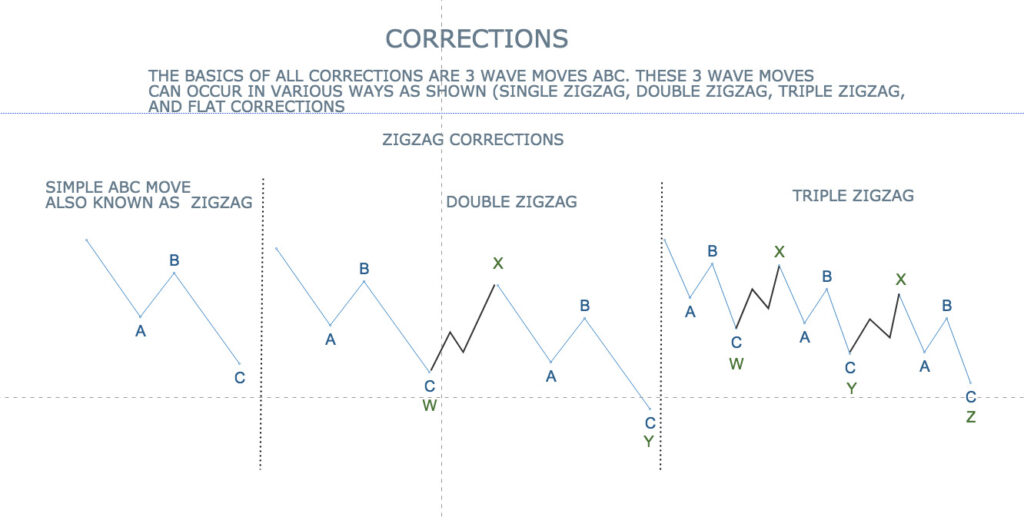

Timing the 5th wave in Elliott Wave analysis is relatively more difficult because it is often the final wave of the trend and can exhibit significant variability in its structure and duration. In our case, the 5th wave is the 5th wave IN A SMALLER DEGREE(Or the upward trend to continue with intermittent corrections) The 5th wave can be an extended wave, (WHICH IT IS IN OUR CASE) meaning it is much longer than the other waves in the trend, or it can be a truncated wave, meaning it fails to reach the projected target level. Additionally, the 5th wave can be influenced by external factors such as SHORT COVERING, economic news releases, or geopolitical events that may cause unexpected changes in market sentiment and price movements.

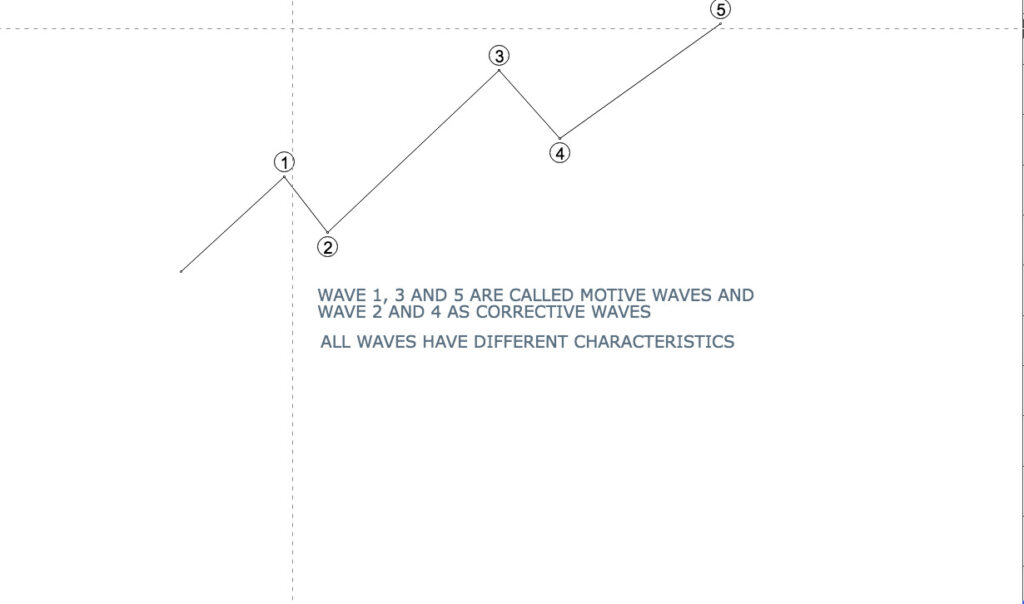

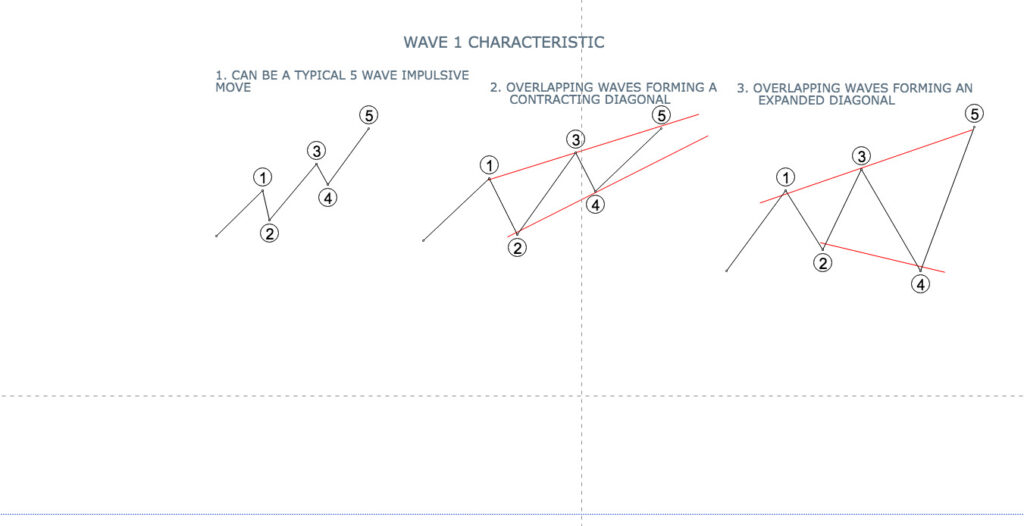

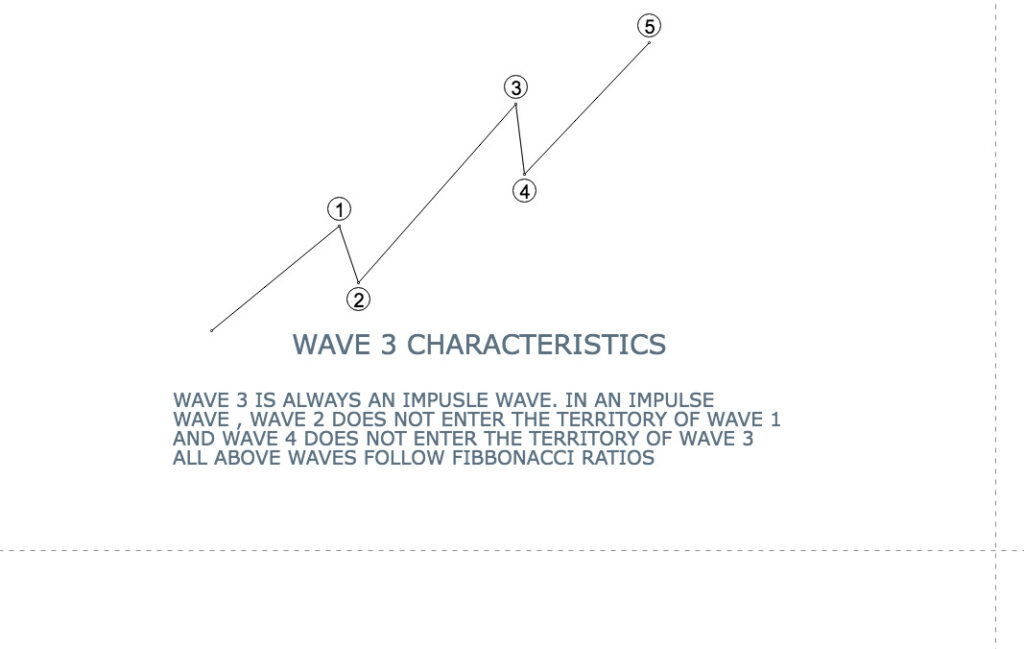

The market is completing (OR ON THE VERGE OF COMPLETING ) THE IMPULSE WAVE COMMENCED FROM 17560.

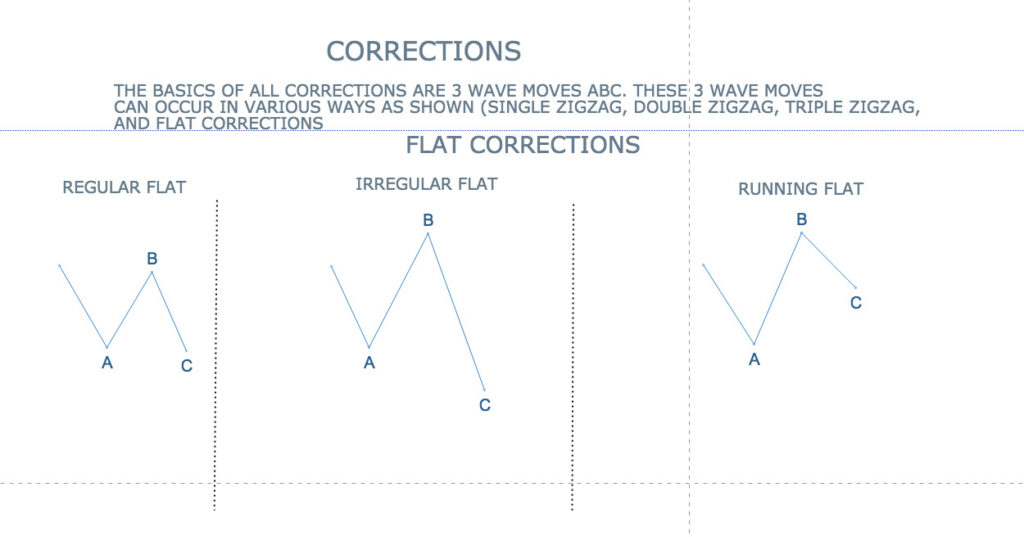

We also need to consider this as a VERY strong bull run(As discussed earlier, when the wave extend, it is a pointer towards strong upward momentum) In extended waves, it is not uncommon to see very shallow corrections in wave 2.

So in the final analysis, the takeaway is following

1. The 3rd wave and the 5th wave IN THE SMALLER DEGREE have extended pointing towards a strong bull run in the FINAL 5TH WAVE OF THE “CYCLE ” DEGREE.

2. 5th waves are relatively difficult to predict.

3. One must consider an ONGOING STRONG BULL RUN with intermittent corrections taking cognizance of OVERBOUGHT OVERSOLD CONDITIONS.