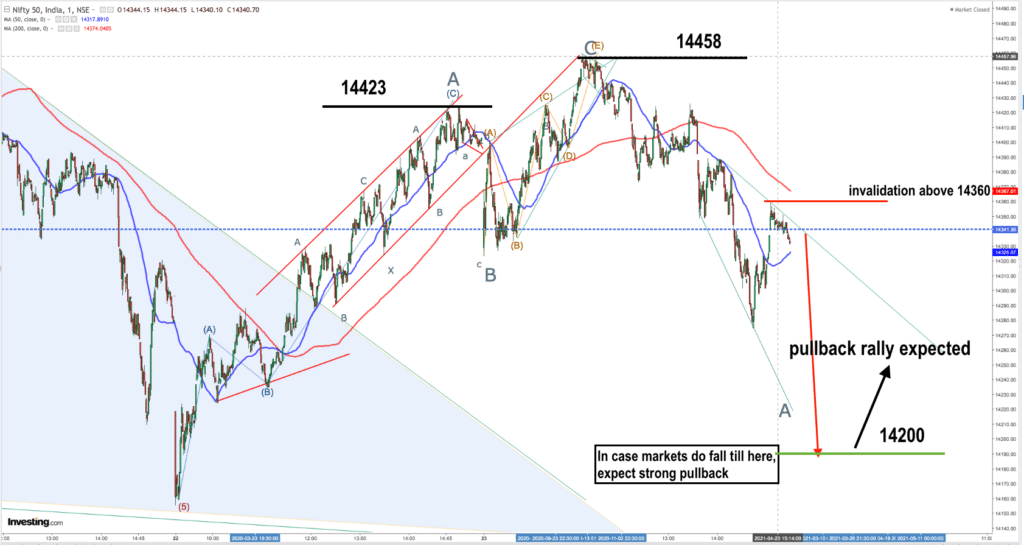

NIFTY

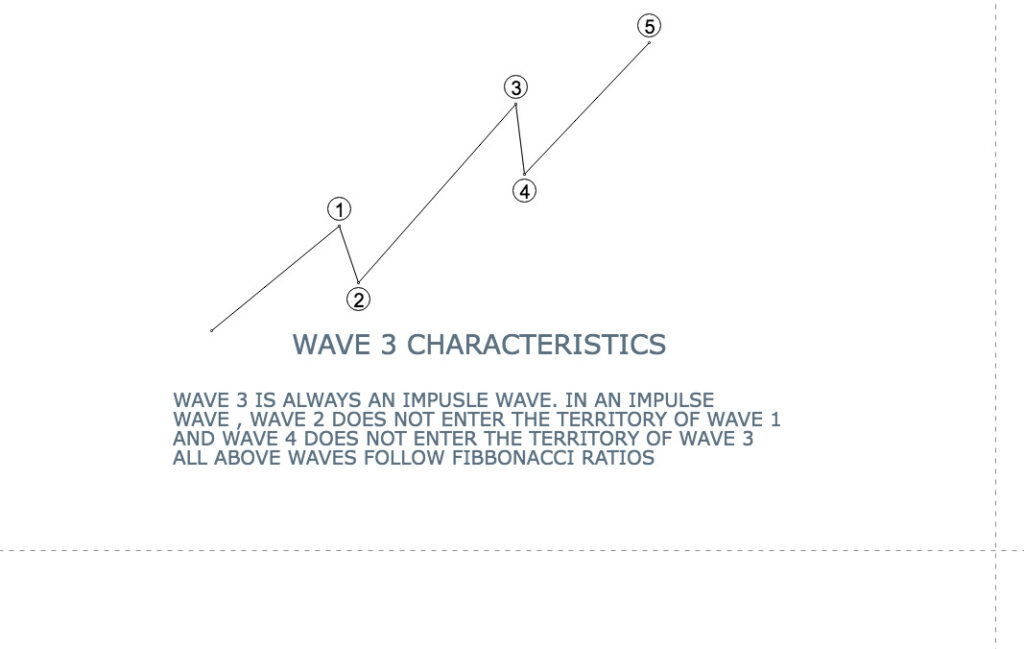

I am giving the nifty intraday (chart above) before the full analysis for the nifty to explain the concept.

As we can see the rise till the points marked A (14423 ) and C (14458 ) are by definition clearly corrective in nature.

Therefore even if we rise from the current point , it will still be part of the larger corrective and the markets should not go beyond the 14575 mark.(from where the markets will again start falling in earnest). Remember a corrective can have within itself pullbacks too in a larger bear trend.

On the other hand if we go down from the current point it will be in line with the ongoing corrections. The down target will be then at least 14200.

Our original concept of the markets being in a medium term bear run still stand. (Markets to fall from current position OR rise till 14575 and then take a deep plunge.

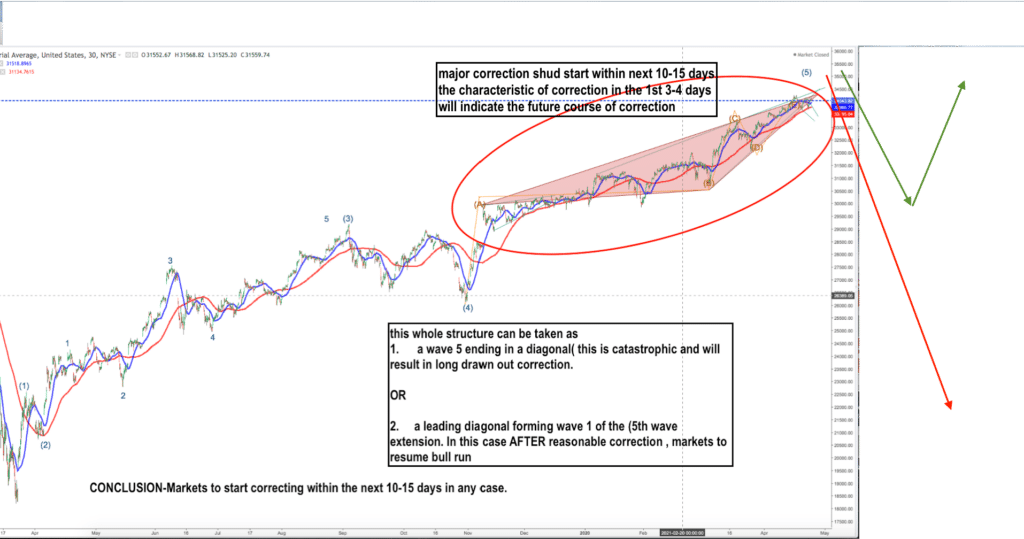

DOW JONES (DJIA)

I have given two seperate possibilities above. Both are indicated by the red arrow and the green arrows. Both have one thing in common and that is that the DJIA will have a substantial correction very soon.

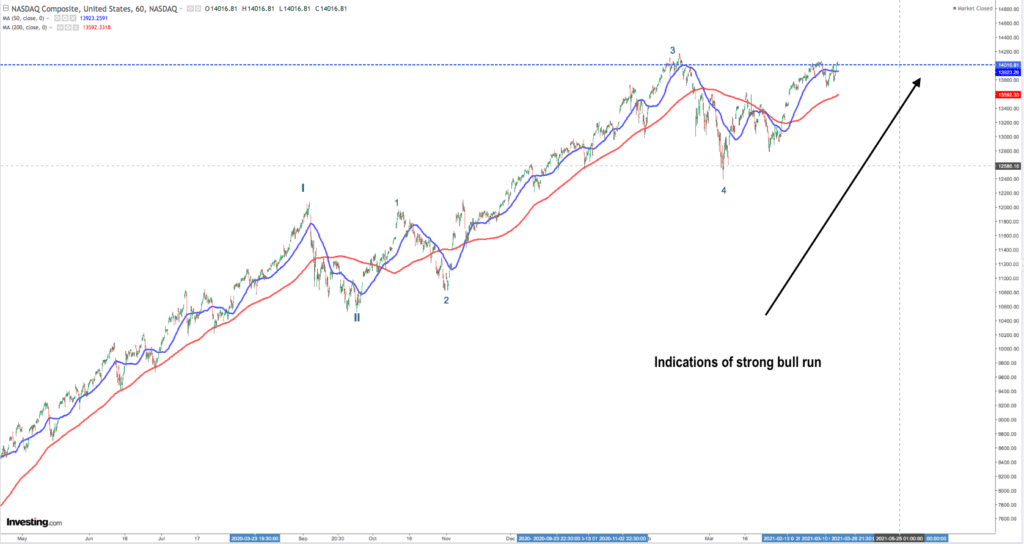

NASDAQ

Nasdaq surprisingly is showing strength and signs of a very strong bull run. This is at a dichotomy with the Dow jones and S&P. In coming days things will become more clear.

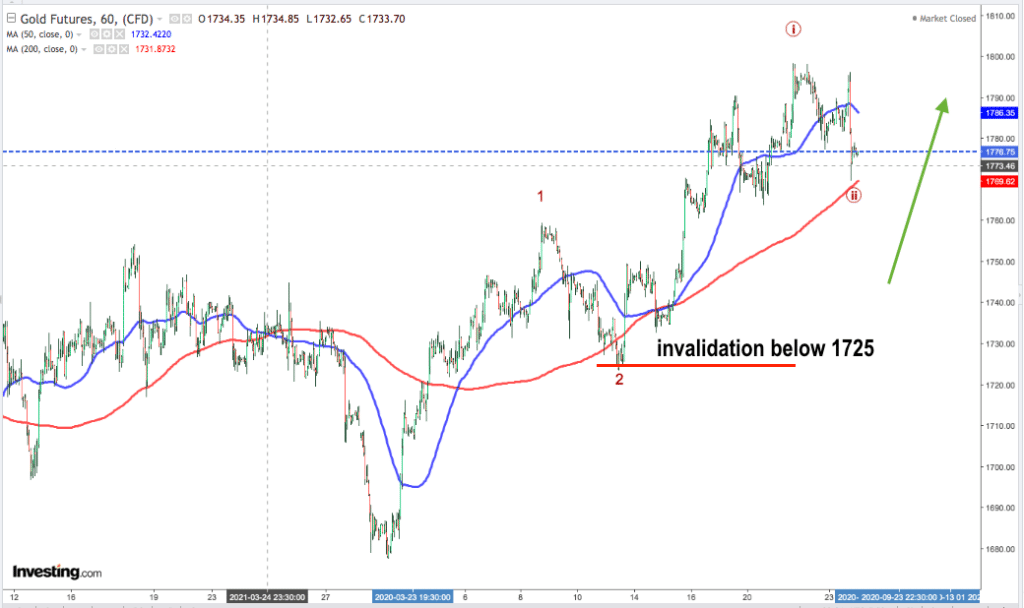

GOLD

GOLD

Gold continues to show strength . In my last post i had given a target of 1804, which has been almost achieved.

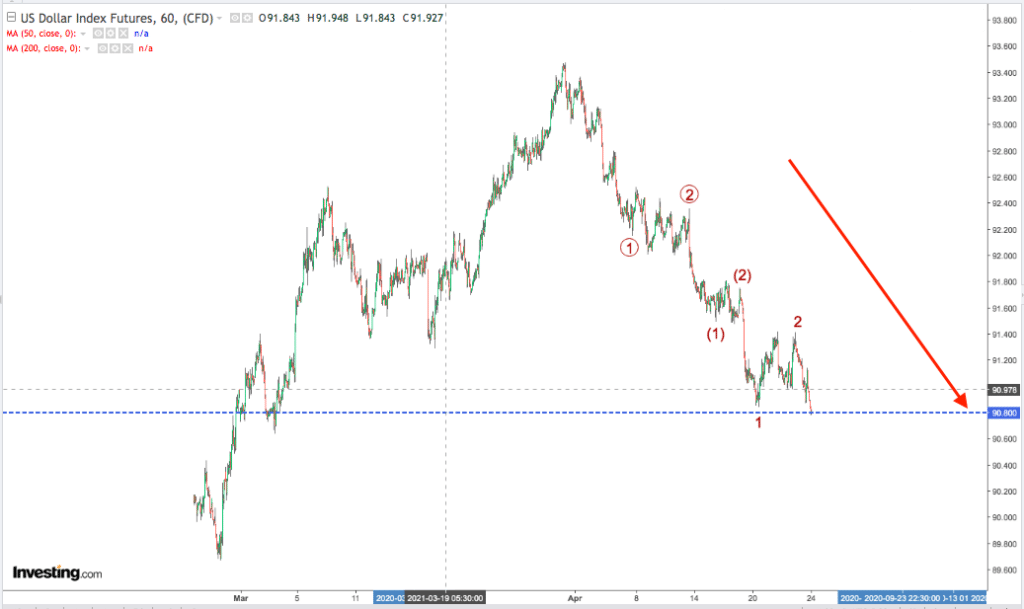

US DOLLAR INDEX (IN USD)

I had indicated in my last post that us dollar index will continue to fall.

This is in a bear fall and we should see much lower levels in the coming days.