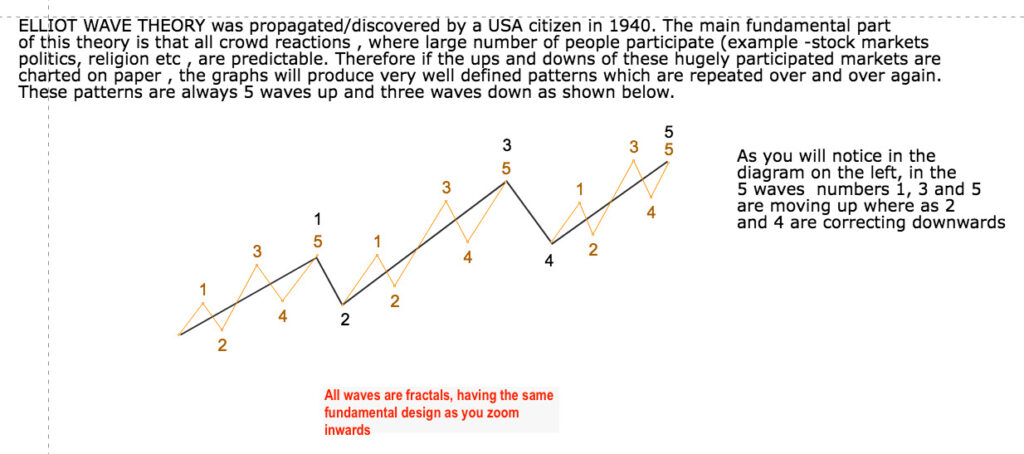

We have completed one pattern on the downward side at the point marked “Z” in the chart above. Subsequently, we pushed upward and now are nearly 600 points above the bottom. Elliot wave is all about a RANGE of possibilities and as and when we go lower our range becomes narrower and finally only one possibility remains.

Presently markets have made an impulse pattern with 4 out of 5 waves complete. We need to go up to the orange rectangle marked to complete the present impulse wave. Once this impulse wave is completed, we will need to see the PRICE ACTION at the correction to CONFIRM the start of the last bull run in the cycle.

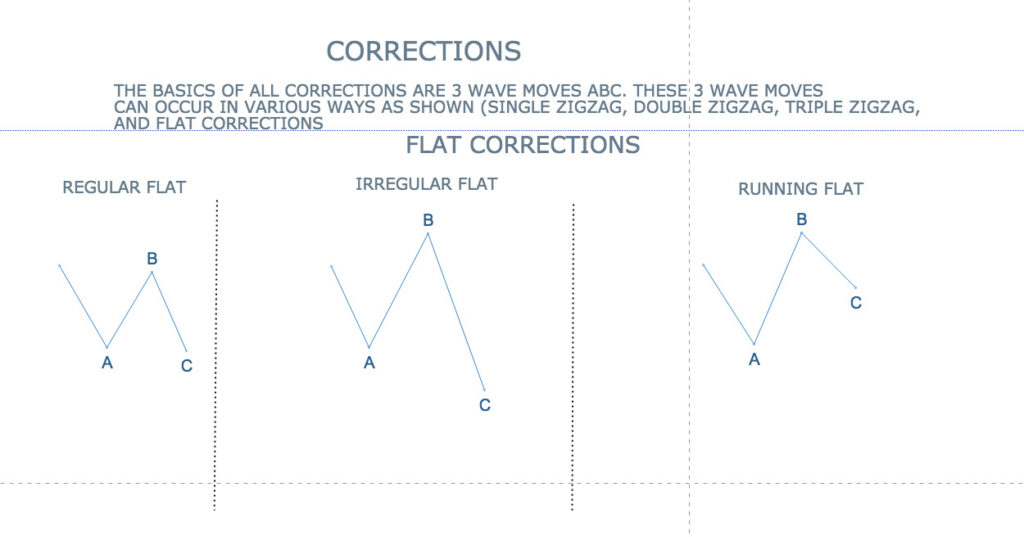

I have drawn a flat correction at the present price (abc)

In Elliott Wave Theory, a flat correction is a three-wave corrective pattern that moves sideways in price and appears in the midst of an overall trend. It is called a “flat” correction because the price action seems to flatten out compared to the impulsive waves that form the trend.

A flat correction is composed of a 3-3-5 wave structure, meaning the first wave is a three-wave pattern, the second wave is also a three-wave pattern, and the final wave is a five-wave pattern. The three waves in the first and second sub-waves of the correction are labeled as a-b-c, with the “a” and “b” waves typically moving in the opposite direction of the overall trend, and the “c” wave moving in the same direction as the overall trend.